A U.S. state has issued a cease and desist order to a company purportedly engaged in cryptocurrency mining. This order follows a temporary cease and desist order to the company two months ago which it did not respond to.

Also read: Yahoo! Japan Confirms Entrance Into the Crypto Space

Cease and Desist Order

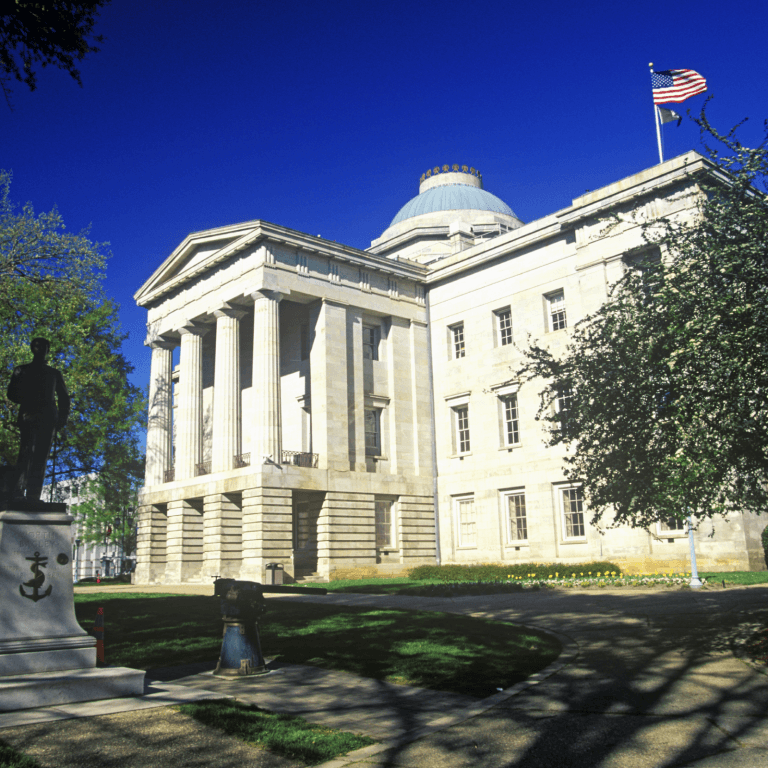

The U.S. State of North Carolina issued a cease and desist order to Power Mining Pool (PMP) last week. After some investigation, the state’s Securities Division declared:

The Securities Division found that PMP is violating the Securities Act by: a. offering unregistered securities in the form of ‘mining pool shares;’ b. offering securities while it is not registered to do so; and c. making material misstatements when offering securities.

They also must not act as a securities dealer, salesman, or agent unless registered with the state. Furthermore, they must not engage in fraud in connection with the offer or sale of any security, or violate other provisions and rules of the state.

This order follows a temporary cease and desist order issued by the same division on March 2. However, the company has neither responded to the order nor requested a hearing. Instead, its website, which is its principal place of business, went offline on March 6, the order revealed.

Questionable Operations

The State of North Carolina described PMP as an online business that is unregistered in any jurisdiction, without a physical place of business and “The individuals who managed PMP are not identified.”

The company represents that it owns and operates mining rigs capable of mining seven different cryptocurrencies 24 hours a day, 7 days a week. It also represents that these rigs track the profitability of each of the seven cryptos and automatically “switch resources away from less profitable coins.”

Investors can also “trade the mined coins for bitcoin.” PMP claims that it will pay the investors “on any profits we make in the trading pool” every three hours.

The Secretary of State of North Carolina wrote:

The mining pool shares are securities and are not registered with the Administrator…PMP willfully fails to disclose material facts when offering the mining pool shares.

What do you think of North Carolina shutting down Power Mining Pool? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

Yahoo! Japan Corporation (TYO: 4689) announced on Friday that it is entering the cryptocurrency space. The company expects to launch an “easy-to-use exchange” for cryptocurrencies in the fall of this year, Nikkei elaborated.

Yahoo! Japan Corporation (TYO: 4689) announced on Friday that it is entering the cryptocurrency space. The company expects to launch an “easy-to-use exchange” for cryptocurrencies in the fall of this year, Nikkei elaborated. Through its wholly owned subsidiary Z Corporation, Yahoo! Japan confirmed the purchase of a 40 percent stake in a crypto exchange called Bitarg Exchange Tokyo Co. Ltd. A person familiar with the matter said that the deal is likely to “total 2 billion to 3 billion yen ($18.6 million to $27.9 million),” Reuters reported. The remaining 60% is still owned by CMD Lab, the parent company of Bitarg.

Through its wholly owned subsidiary Z Corporation, Yahoo! Japan confirmed the purchase of a 40 percent stake in a crypto exchange called Bitarg Exchange Tokyo Co. Ltd. A person familiar with the matter said that the deal is likely to “total 2 billion to 3 billion yen ($18.6 million to $27.9 million),” Reuters reported. The remaining 60% is still owned by CMD Lab, the parent company of Bitarg. Bitarg was established in May of last year. However, the exchange temporarily suspended its service in August 2017, according to Business Insider Japan. The company

Bitarg was established in May of last year. However, the exchange temporarily suspended its service in August 2017, according to Business Insider Japan. The company

The South African Reserve Bank (SARB) has set up a team to monitor fintech developments and assist its efforts to finalize the regulatory regime for cryptocurrencies. Representatives of the private sector have proposed the creation of a Self-regulatory Organization (SRO). While banking falls within the central bank’s jurisdiction, cryptos are not suited to traditional centralized supervision, said a legal expert familiar with the matter.

The South African Reserve Bank (SARB) has set up a team to monitor fintech developments and assist its efforts to finalize the regulatory regime for cryptocurrencies. Representatives of the private sector have proposed the creation of a Self-regulatory Organization (SRO). While banking falls within the central bank’s jurisdiction, cryptos are not suited to traditional centralized supervision, said a legal expert familiar with the matter. In December, the South African Revenue Service announced it was exploring ways to tax bitcoin trading, as

In December, the South African Revenue Service announced it was exploring ways to tax bitcoin trading, as