In this edition of Regulations Roundup, we focus on the U.S. Securities and Exchange Commission’s (SEC) ongoing discussions with companies that are interested in setting up cryptocurrency funds. We also look at a recent warning by the South Korean financial regulator about virtual currency investments, as well as a call by the CEO of U.S. financial giant Circle for G-20 leaders to reach consensus on rules for cryptocurrencies.

Also Read: Indian Court Gives Government Two Weeks to Submit Crypto Report

SEC ‘Serious’ About Fund Proposals

“We actually released a staff letter not too long ago talking about some of the critical issues we will be looking at, which include valuation, liquidity, custody, and making sure that firms are thinking through how they are going to deal with all of those issues,” Stein said.

However, she declined to say whether U.S. investors can expect to see a regulated cryptocurrency exchange-traded fund within the next year. “I don’t know the answer to that,” she said. “It’s all going to be based on facts and circumstances.”

Stein explained that the SEC still needs to clarify a number of important regulatory considerations before any significant progress can be made.

“Whatever fund presents a concept to us [will] have to show how they can get accurate valuations, despite sometimes volatile price swings, how they can make sure that there is physical custody, when necessary, how they can guarantee that there is adequate liquidity, especially in a 40 Act fund context, so that investors can get their money when they need to get their money,” she said. “So we’ll look at all of those factors and make a decision based on that particular fund and how its actually going to be able to handle those particular requirements.”

South Korea’s FSA Urges Caution on Crypto

The FSA said that in addition to being formally unregulated, cryptocurrency funds do not meet the requirements of the country’s Capital Markets Act. It therefore encourages investors to consult with the relevant authorities before investing.

Circle CEO Calls for G-20 Consensus

“Ultimately there needs to be normalization at the G-20 level of critical crypto-related regulatory matters,” Allaire said.

Allaire also urged regulators throughout the world to establish transnational norms regarding initial coin offerings. “When it comes to token offerings, how should they be treated? Which token offerings are securities, which are not?” he asked. “The trading venues — are they like spot commodity markets that need to have rules in place around market manipulation?”

Do you think that U.S. investors will have access to a cryptocurrency exchange-traded fund within the next 12 months? Share your thoughts in the comments section below!

Images courtesy of Shutterstock

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

Cointext has started offering its SMS BCH wallet in Brazil, Poland, Croatia and Romania. It also now provides support for the Polish, Croatian and Romanian languages across the entire platform, the company said.

Cointext has started offering its SMS BCH wallet in Brazil, Poland, Croatia and Romania. It also now provides support for the Polish, Croatian and Romanian languages across the entire platform, the company said. Cointext has rapidly expanded throughout the world since the company launched the service in March of this year. The startup’s entry into its four newest markets brings the total number of countries that are connected by the Cointext service to 29. The locations now supported include the U.S., Canada, South Africa, Switzerland, Sweden, Netherlands, the U.K., Germany, France, Austria, Portugal, Estonia, the Czech Republic, Hong Kong, Israel, Palestine, Argentina and Turkey.

Cointext has rapidly expanded throughout the world since the company launched the service in March of this year. The startup’s entry into its four newest markets brings the total number of countries that are connected by the Cointext service to 29. The locations now supported include the U.S., Canada, South Africa, Switzerland, Sweden, Netherlands, the U.K., Germany, France, Austria, Portugal, Estonia, the Czech Republic, Hong Kong, Israel, Palestine, Argentina and Turkey.

The

The

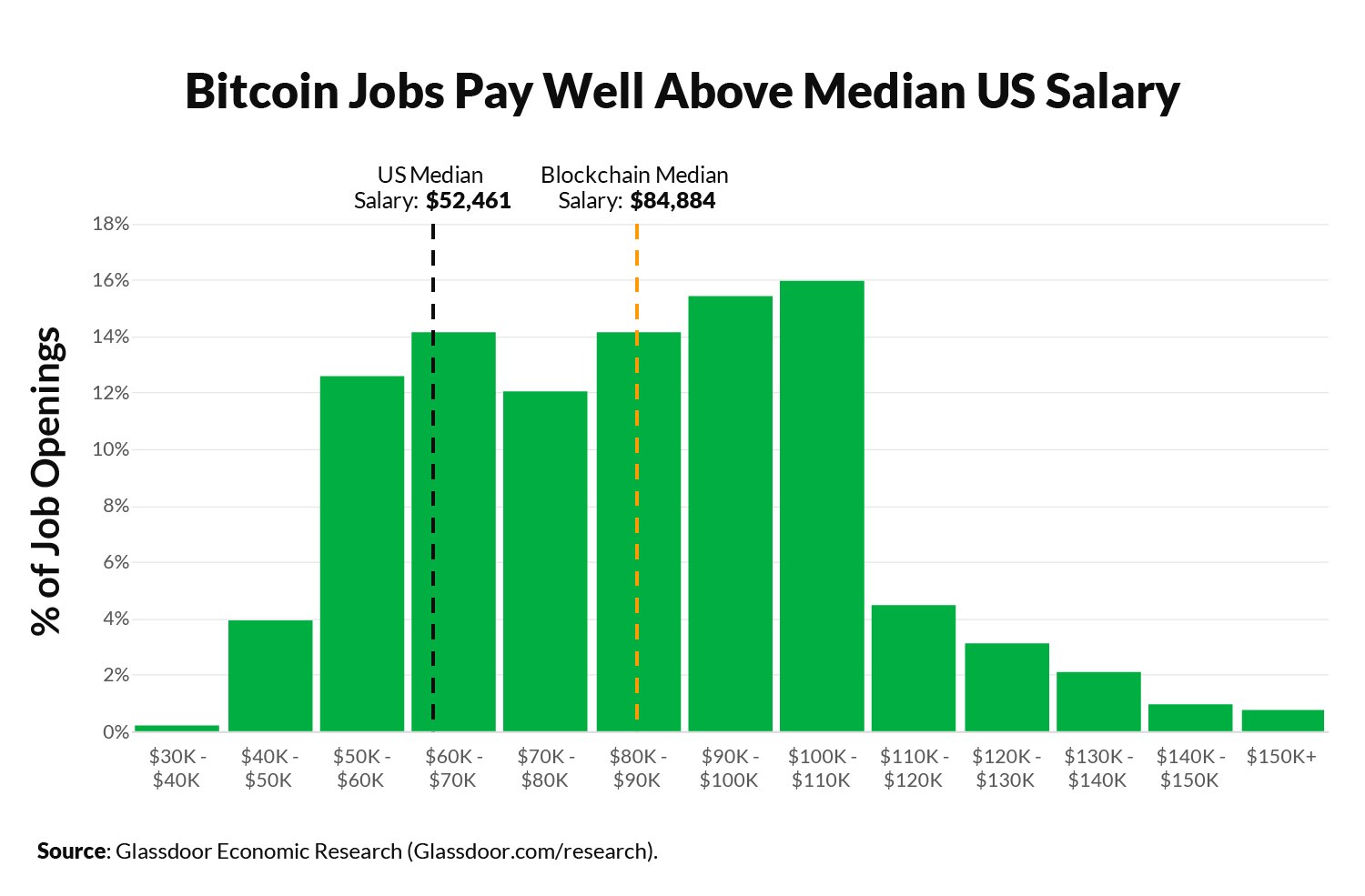

For anyone looking to enter the cryptocurrency space, it seems you can’t go wrong by acquiring software programming skills. Software engineers are the most in-demand individuals, with such jobs accounting for 19 percent of all listings. These openings are followed by more specialized positions, such as vacancies for front-end engineers and technology architects; in total, engineering-related positions account for 55 percent of the entire crypto-jobs segment.

For anyone looking to enter the cryptocurrency space, it seems you can’t go wrong by acquiring software programming skills. Software engineers are the most in-demand individuals, with such jobs accounting for 19 percent of all listings. These openings are followed by more specialized positions, such as vacancies for front-end engineers and technology architects; in total, engineering-related positions account for 55 percent of the entire crypto-jobs segment.

The London-based crypto exchange, which is backed by Transferwise founder Taavet Hinrikus and venture capital firm Passion Capital, is the first offshore company to gain recognition as a

The London-based crypto exchange, which is backed by Transferwise founder Taavet Hinrikus and venture capital firm Passion Capital, is the first offshore company to gain recognition as a  Earlier this month, it was reported that Coinfloor would lay off most of its roughly 40 employees, citing the prolonged cryptocurrency bear trend as the catalyst for the move. At the time, Nwosu said the company had witnessed “significant change in trade volume across the market,”

Earlier this month, it was reported that Coinfloor would lay off most of its roughly 40 employees, citing the prolonged cryptocurrency bear trend as the catalyst for the move. At the time, Nwosu said the company had witnessed “significant change in trade volume across the market,”

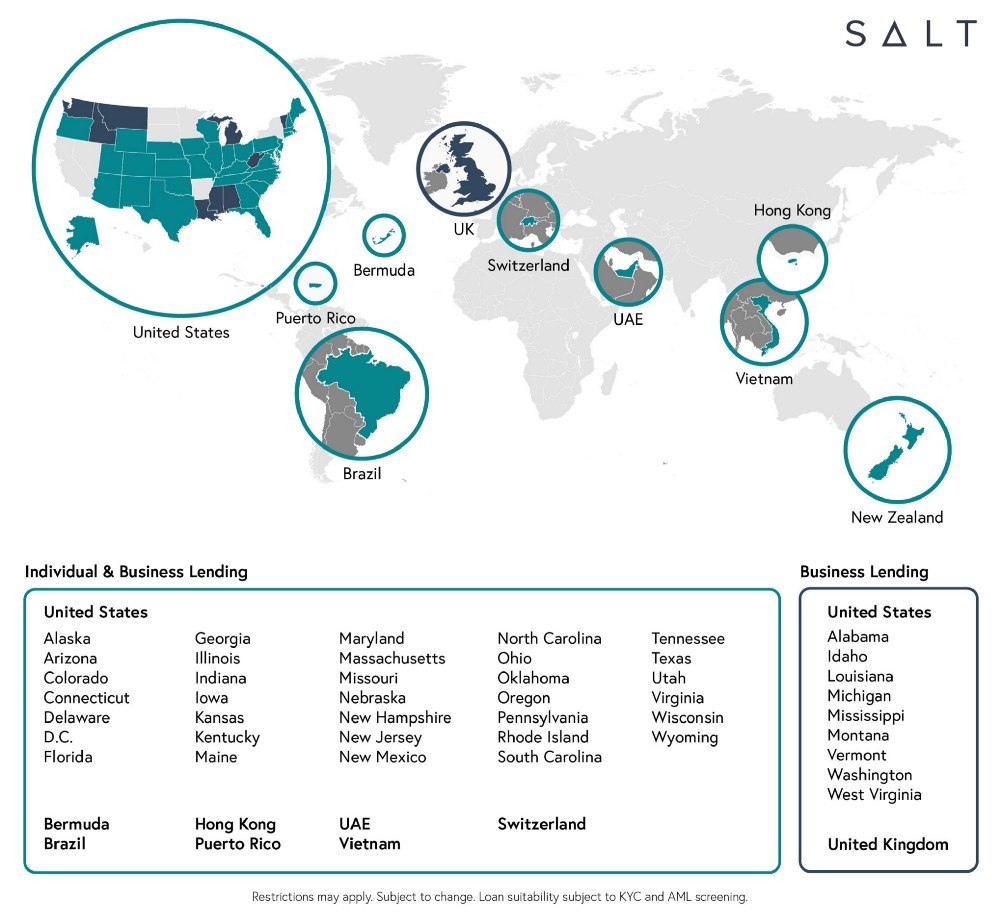

The combined news appears to have moved Salt’s proprietary token, SALT, up considerably. At one point it jumped 55%, with over $20 million flowing to the project — a 1,478% increase over previous levels. Analysts suggest the addition of litecoin to its bitcoin core and ether secure loan offerings drove speculators to pump the 109th-ranked token by market capitalization.

The combined news appears to have moved Salt’s proprietary token, SALT, up considerably. At one point it jumped 55%, with over $20 million flowing to the project — a 1,478% increase over previous levels. Analysts suggest the addition of litecoin to its bitcoin core and ether secure loan offerings drove speculators to pump the 109th-ranked token by market capitalization.