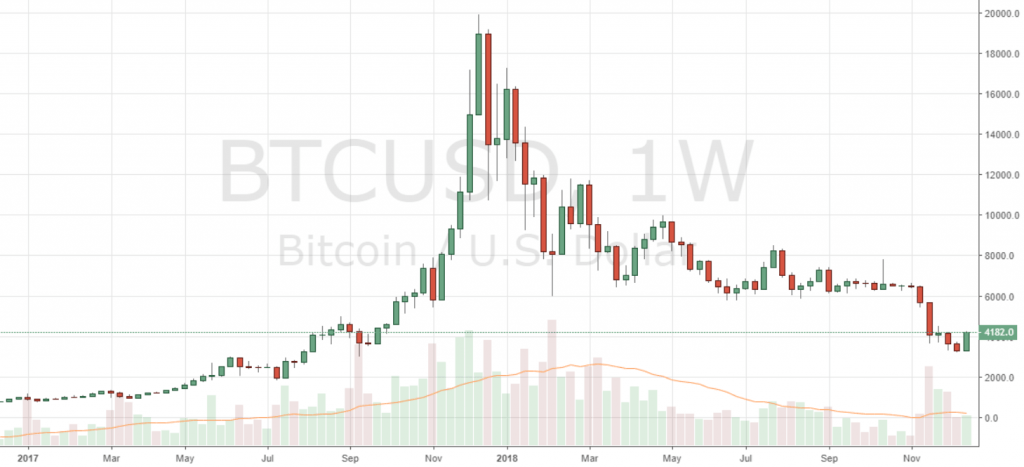

A report recently published by Diar has estimated that nearly $15.42 billion of value was added to the market capitalization of the combined cryptocurrency markets in the form of newly created tokens and crypto asset inflation during 2018.

Also Read: Bitcoin Climbs up China’s First Crypto Ranking of 2019

12 Percent of Current Crypto Market Cap Was Created During 2018

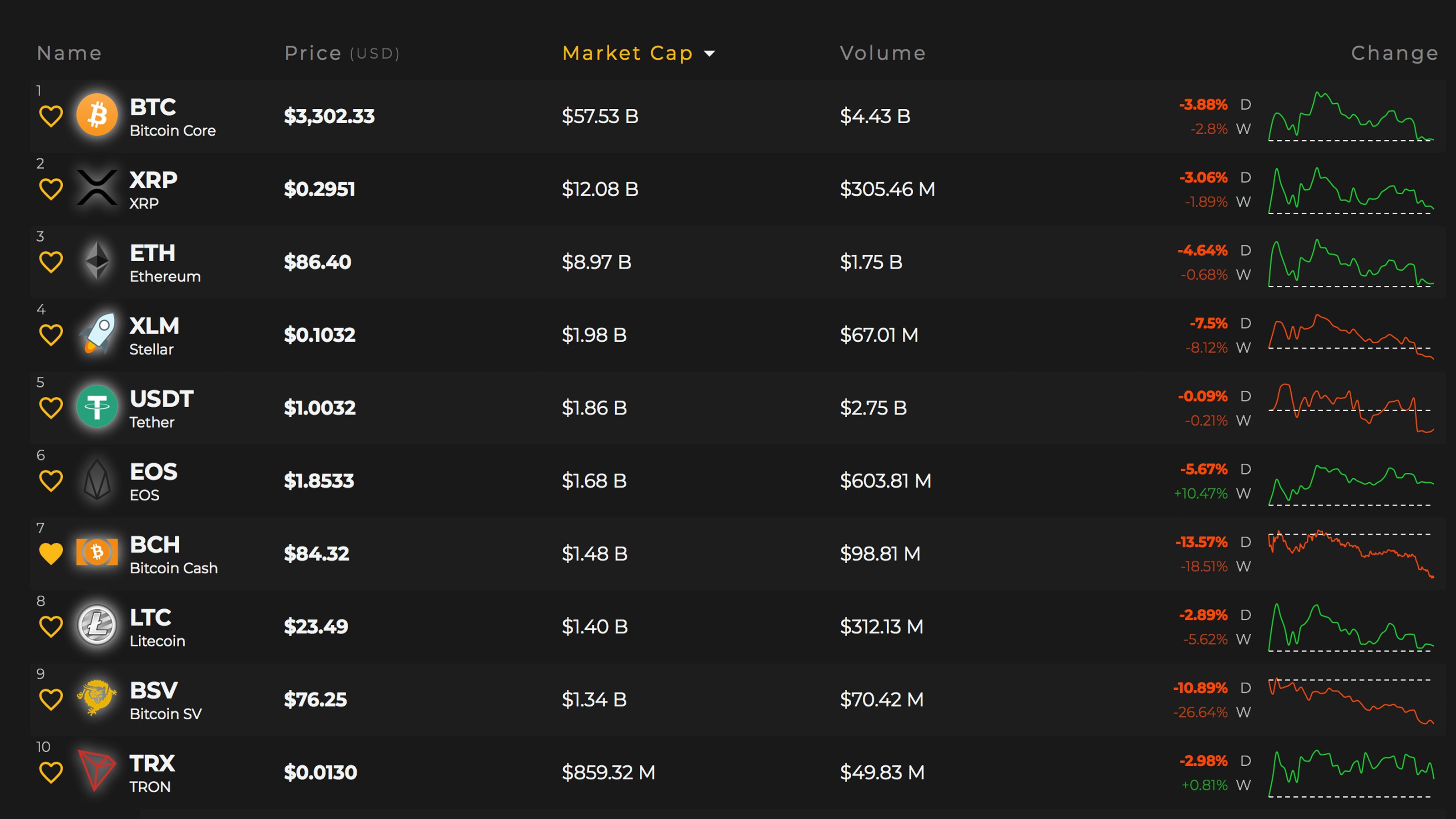

According to Diar’s report, new crypto asset value created during 2018 is estimated to comprise more than 12 percent of the current combined cryptocurrency market cap.

The largest contribution to newly created value during 2018 was new token additions, representing $4.96 billion, or 32 percent of the $15.42 billion that was added to the markets last year.

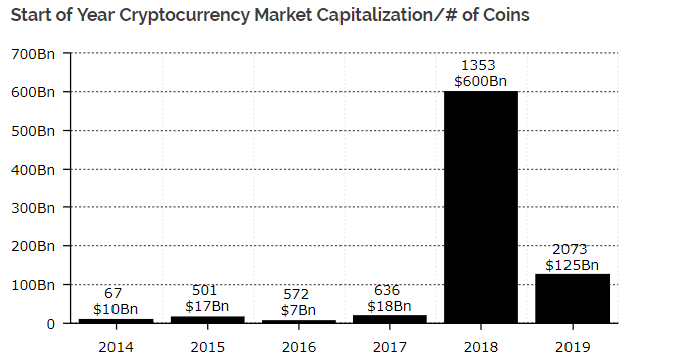

More than 700 new crypto assets entered into circulation during 2018, a more than 50 percent increase when compared with the start of 2018, and an addition of 110 percent of the number of circulating cryptocurrencies as of the start of 2017.

BTC and ETH Added 27 Percent of Newly Created Value Last Year

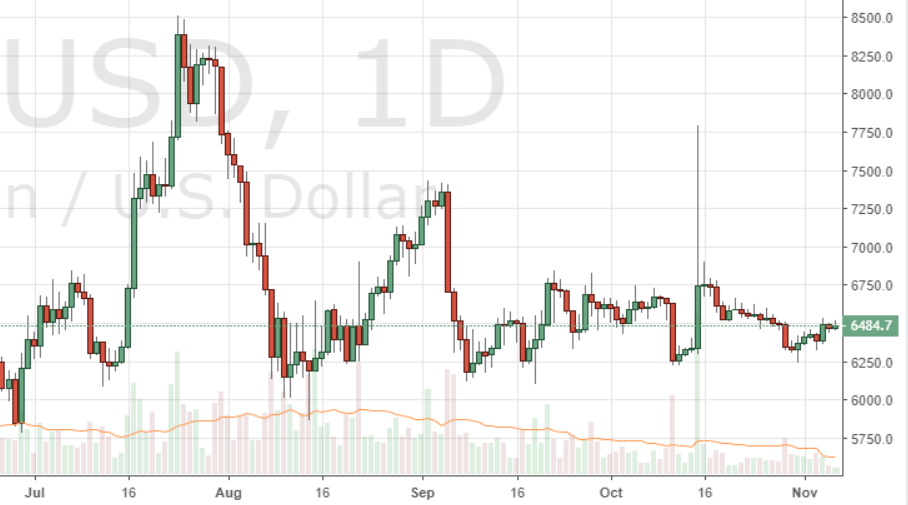

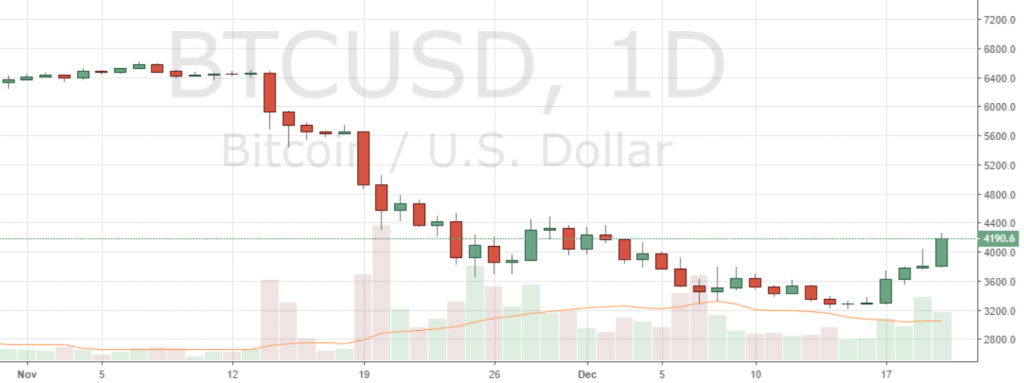

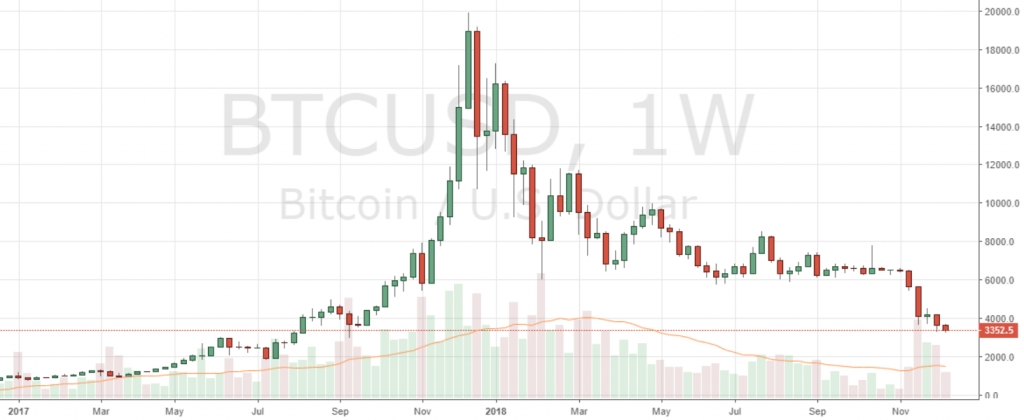

BTC added roughly $2.63 billion to the combined crypto asset market cap during 2018, with inflation and newly mined BTC comprising 17 percent of new value added to the cryptocurrency markets, forming the largest contribution made by a single virtual currency.

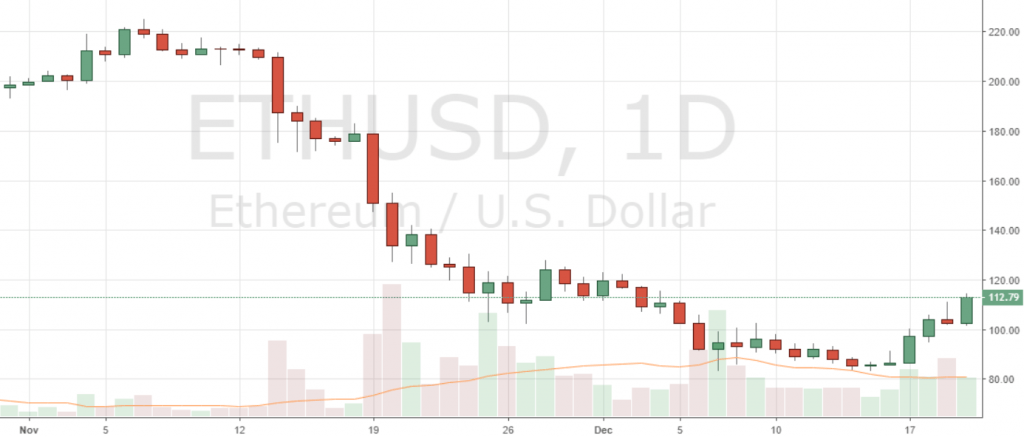

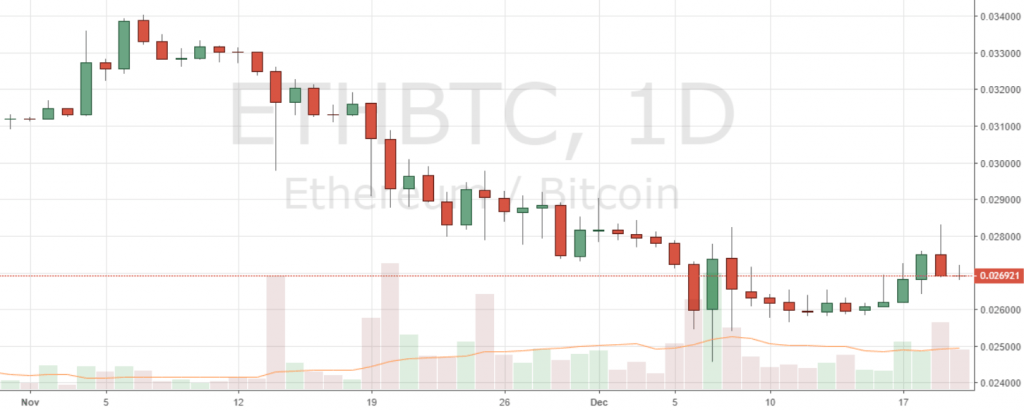

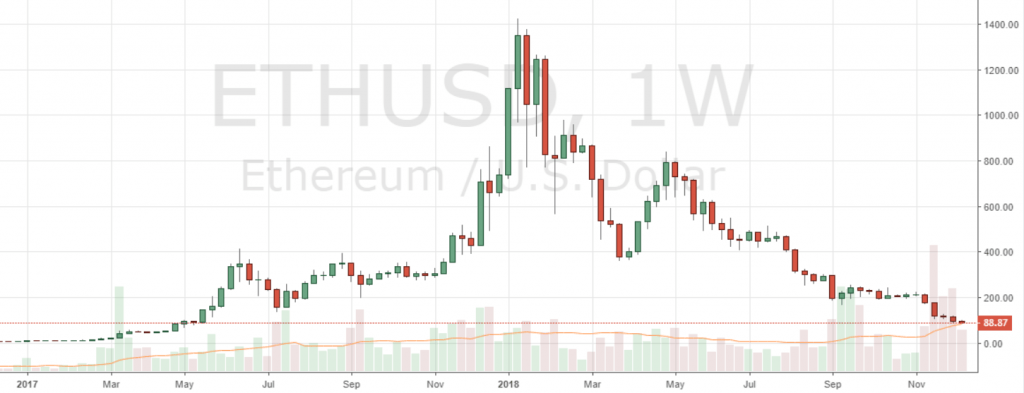

New value created in the form ETH comprised the second largest contribution from a single market to the combined cryptocurrency capitalization during 2018, adding $1.55 billion, or 10 percent of new value.

Inflation on all other cryptocurrency tokens that were circulating as of the start of 2018 added a further $4.17 billion to the combined market cap, comprising 27 percent of last year’s newly created crypto asset value.

Burned Tokens Removed $195 Million From Combined Market Cap in 2018

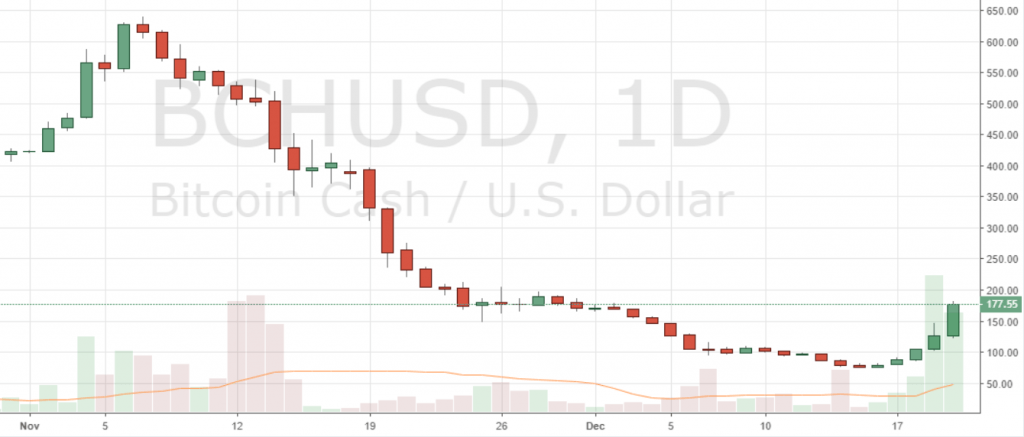

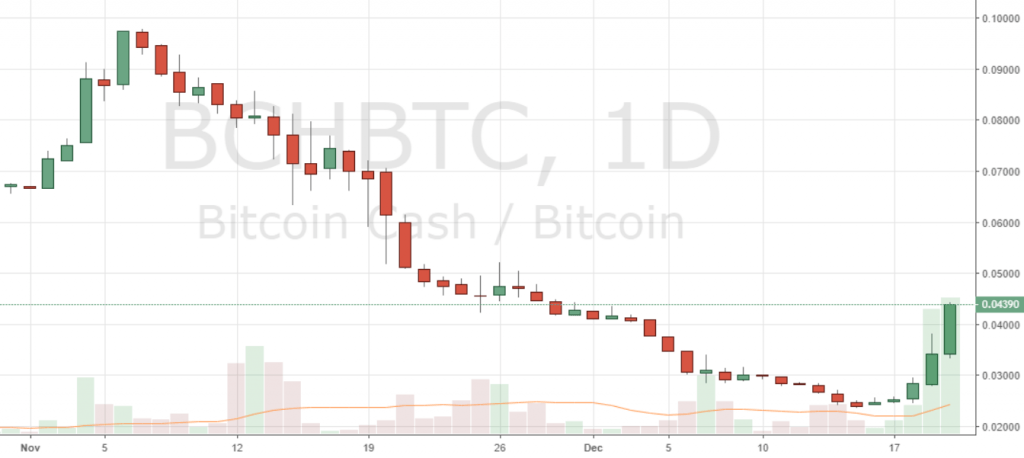

Newly issued stablecoins comprised a significant contribution to the cryptocurrency market cap, adding more than $1.26 billion in value. The BSV fork also comprised a notable source of new crypto asset value, adding $1.04 billion to the combined cryptocurrency market cap.

Finally, burned tokens comprised $195 million in value that was removed from the combined cryptocurrency market cap during 2018.

Are you surprised that $15.4 billion of last year’s newly created cryptocurrency value survived to see 2019? Share your thoughts in the comments section below!

Images courtesy of Shutterstock, Diar

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

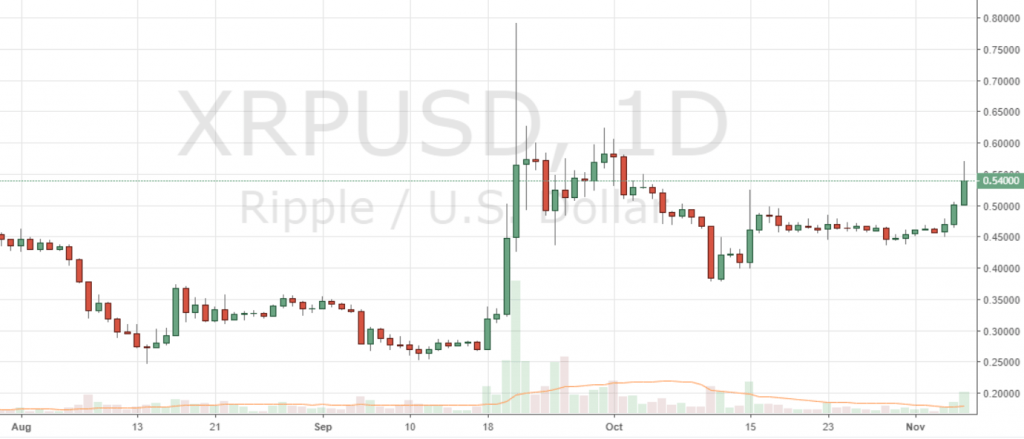

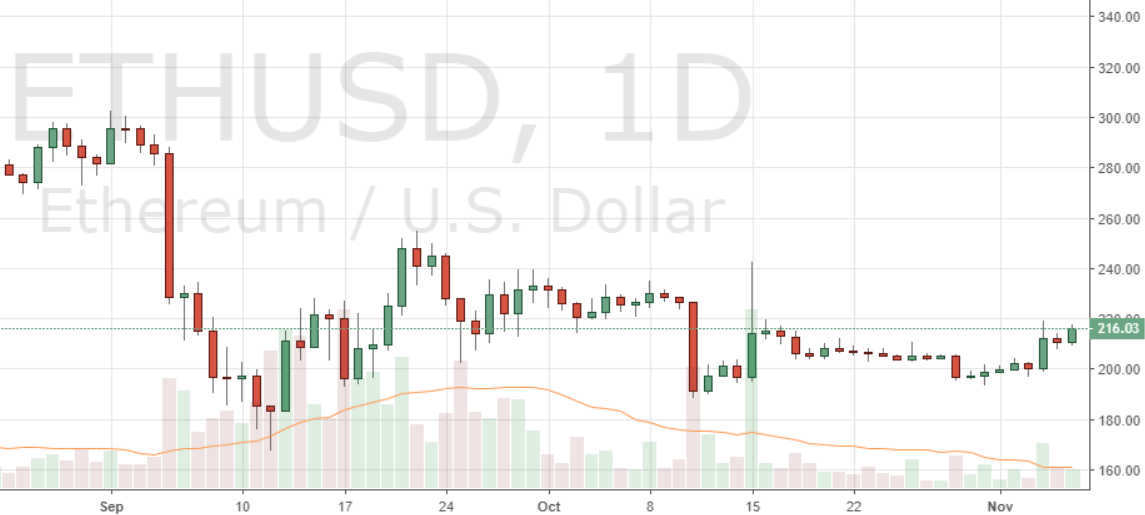

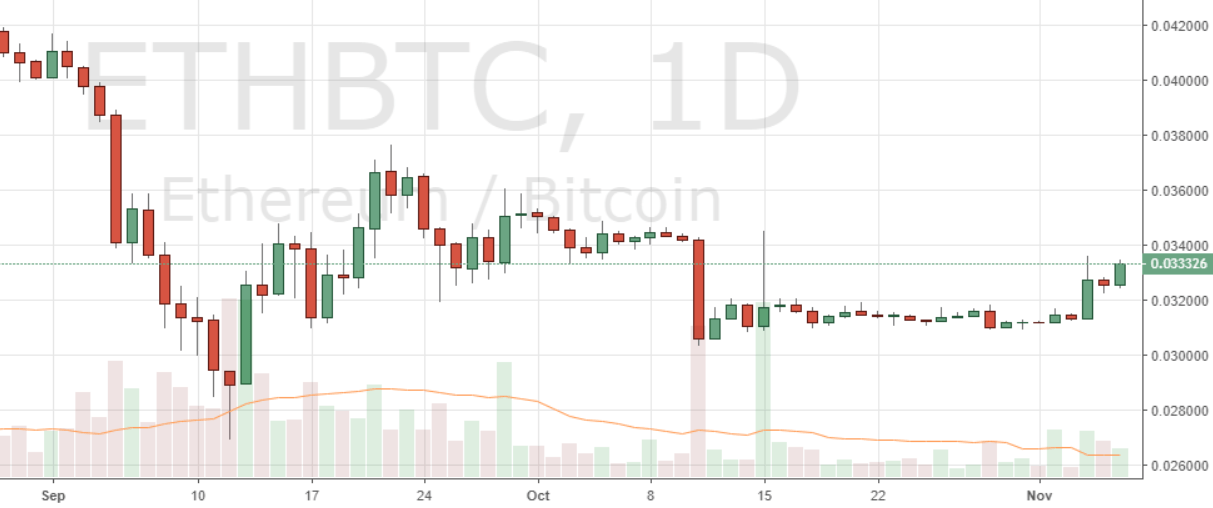

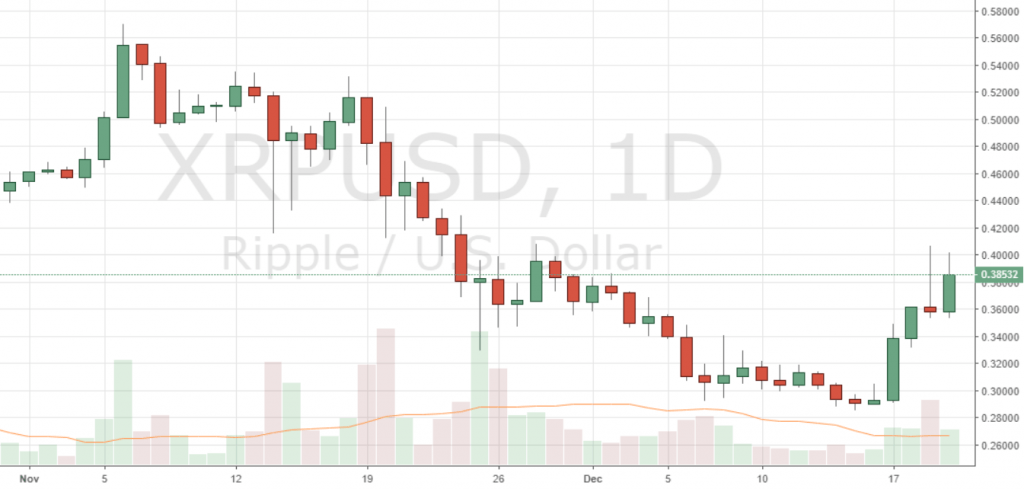

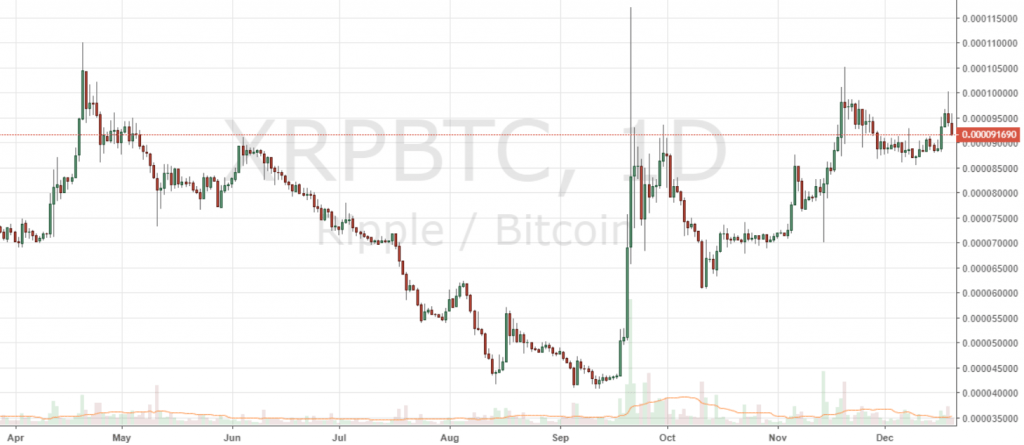

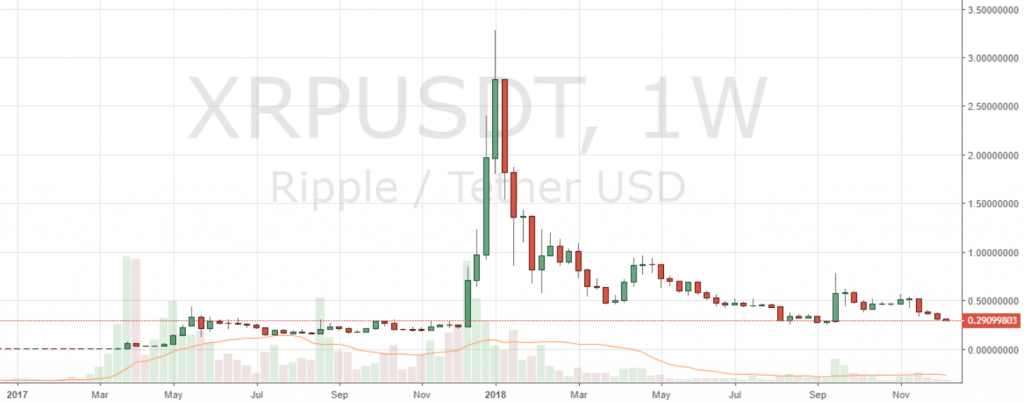

Ripple has rallied to rival ethereum as the second largest cryptocurrency by market capitalization for the first time since

Ripple has rallied to rival ethereum as the second largest cryptocurrency by market capitalization for the first time since